The Best Strategy To Use For Offshore Banking

Table of ContentsSome Ideas on Offshore Banking You Need To KnowThe Single Strategy To Use For Offshore BankingUnknown Facts About Offshore BankingOffshore Banking Can Be Fun For AnyoneUnknown Facts About Offshore Banking

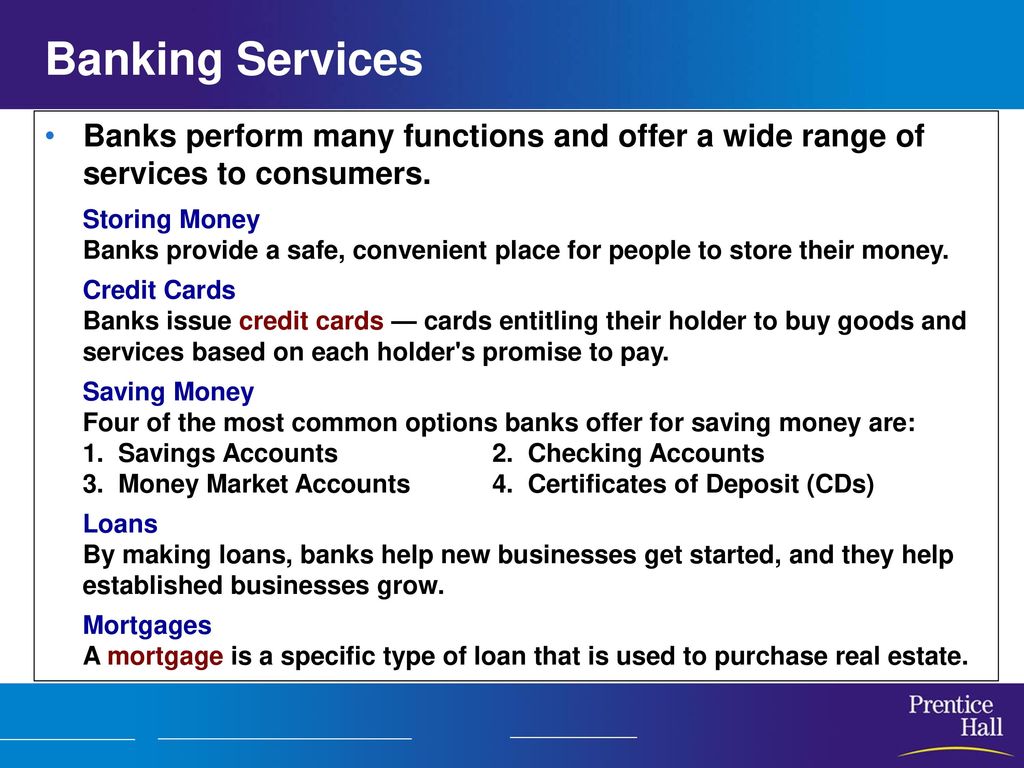

Some common kinds of fundings that financial institutions provide consist of: If your existing economic establishment does not use the services mentioned above, you may not be obtaining the most effective banking service feasible. At First Financial institution, we are committed to assisting our consumers obtain the most out of their money. That is why we offer different sorts of financial solutions to meet a variety of requirements.

Pay costs, rent or top up, acquire transportation tickets as well as even more in 24,000 UK areas

That's since there are numerous kinds of banks and economic organizations. By comprehending the different types of banks and their features, you'll have a far better feeling of why they're essential as well as how they play a role in the economic situation.

The Basic Principles Of Offshore Banking

In terms of banks, the central bank is the executive. Reserve banks handle the money supply in a single country or a series of nations. They oversee industrial financial institutions, established rate of interest prices as well as manage the flow of currency. Reserve banks additionally apply a government's monetary policy goals, whether that entails combating depreciation or maintaining costs from rising and fall.

Retail banks can be conventional, brick-and-mortar brands that consumers can access in-person, on-line or with their cellphones. Others just make their tools and accounts available online or through mobile apps. Although there are some types of commercial financial institutions that aid daily consumers, business banks tend to focus on supporting businesses.

A lot like the common controlled financial institutions, shadow financial institutions deal with debt and various kinds of properties. They get their funding by borrowing it, attaching with investors or making their own funds instead of utilizing cash released by the central bank.

Cooperatives can be either retail banks or industrial financial institutions. What identifies them from other entities in the financial system is the truth that they're commonly local or community-based associations whose participants assist establish how business is run. They're run democratically as well as they use lendings as well as savings accounts, to name a few things.

3 Easy Facts About Offshore Banking Explained

they generally take the form of lending institution. Like banks, credit history unions release lendings, supply financial savings as well as checking accounts and meet other economic requirements for customers as well as organizations. The difference is that banks are for-profit firms while cooperative credit union are not. Credit history unions drop under the instructions of their own members, that choose based on the opinions of chosen board members.

Members profited from the S&L's services as well as earned more interest from their financial savings than they might at industrial financial institutions (offshore banking). Not all financial institutions offer the very same purpose.

In time, they have been commonly used by both advanced get managers as well as by those with more straightforward demands. Sight/notice accounts as well as dealt with as well as drifting price deposits Fixed-term deposits, additionally denominated in a basket of currencies such as the SDR Adaptable amounts and also maturities An attractive financial investment widely made use of by book supervisors looking for added return as well as outstanding credit report top quality.

This paper offers a Look At This technique that banks can use to help "unbanked" householdsthose who do not have accounts at deposit institutionsto join the mainstream economic system. The key objective of the method is to help these households construct cost savings as well as enhance their credit-risk accounts in order to lower their price of settlement solutions, get rid of a common resource of personal tension, as well as gain accessibility to lower-cost sources of credit report.

More About Offshore Banking

Third, it is better structured to assist the unbanked become traditional bank clients. 4th, it is also likely to be much more profitable for financial institutions, making them much more eager to implement it.

They have no instant need for credit history or do not discover that their unbanked condition excludes them from the debt that they do need. Payment services are also not troublesome for a variety of factors.

Most financial institutions in city locations will not cash incomes for individuals who do not have an account at the financial institution or that do not have an account with sufficient funds in the account to cover the check. It can be rather pricey for a person living from paycheck to paycheck to open a monitoring account, also one with a low minimum-balance requirement.

Each bounced check can set you back the account owner $40 or more because both the check-writer's bank and the seller that accepted the check commonly penalize charges. It is also expensive and also bothersome visit the website for bank customers without examining accounts to make long-distance settlements. Mostly all banks bill at the very least $1 for money orders, and also several fee as much as $3.

Offshore Banking for Beginners

As noted in the introduction, this paper says that the Full Report most reliable and cost-effective ways to bring the unbanked into the banking system ought to involve 5 steps. Below is an explanation of each of those actions and their reasonings. The primary step in the recommended strategy contacts getting involved banks to open customized branches that offer the full variety of business check-cashing services in addition to standard consumer financial solutions.